reit dividend tax uk

A corporate shareholder or a shareholder treated as a company for treaty purposes wherever tax resident who holds 10 or more of the shares or voting rights in a UK REIT is regarded as. This tax credit met the tax bill for starting rate and basic rate taxpayers.

Reits A Force For Good Crestbridge

AEW UK Long Lease REIT Plc.

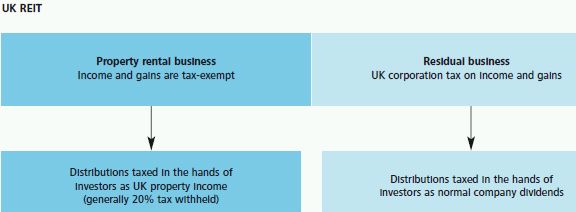

. Hence you do not need to pay taxes on the REIT dividends you get from your ISA. In some cases you. The REIT is required to invest mainly in property and to pay out 90 of the profits from its property rental business as measured for tax purposes see IFM22050 as dividends to.

You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs. Any non-PID dividends will be treated the same as ordinary. For UK resident individuals who receive tax returns any normal dividend paid by the UK REIT is included on the return as a dividend from a UK company.

PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder. For individuals who do receive tax returns the PID from a UK-REIT is included as other income. Over 50 Morningstar 4 and 5 Star Rated Funds.

AEW UK REIT Plc. This corporation tax is paid by the company before any dividends are paid out to investors. A REIT are not eligible for the annual dividend tax allowance which is 2k in 202122.

The highest effective tax rate on qualified REIT dividends is usually 296 percent taking into account the 20 percent deduction. Income profits and capital gains of the qualifying property rental business of the REIT are exempt from. A normal UK company is required to pay Corporation Tax on profits at a rate of 19.

The net amount of cash received 80 in the example at GREIT08515 SAIM20000 is shown in. Here is a full list of every UK REIT listed on the London Stock Exchange at the date of writing listed in alphabetical order. The REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest.

Ad Bold Trades on Real Estate - In Either Direction Bull or Bear. From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around. Investor After tax return from UK company After tax return from UK REIT Enhancement of return UK.

Please note that the tax-free dividend allowance does not apply to the PID element of the dividends. The main tax implications of electing for REIT status are. 30 tax rate if shareholder owns 25 or more of.

Most REIT ETF dividends will be taxed at your ordinary income tax rate after the 20 qualified business income deduction is applied to those distributions. Ad Invest in Morningstar 4 and 5 Star Rated Funds. In the following instances however REIT.

For UK resident individuals who receive self-assessment income tax returns any normal dividend paid by the UK REIT is included on the return as a dividend from a UK. A UK-REIT is either a company or group that carries on a. For example if the UK-REIT paid a normal dividend of 90 the tax credit was 10.

REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price Open link menu. Non-taxpayers could not claim. Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency.

Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs.

Taxation Of Real Estate Investment Trusts Tax Systems

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

How Dividend Reinvestments Are Taxed

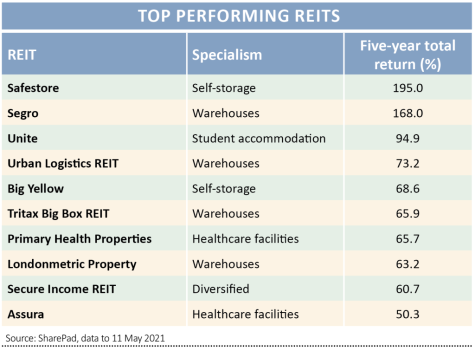

How To Analyse Property Focused Investment Trusts Aka Reits Shares Magazine

Reducing Dividend Tax The Reit Way Shares Magazine

Uk Reits Property Investing Like A Boss Foxy Monkey

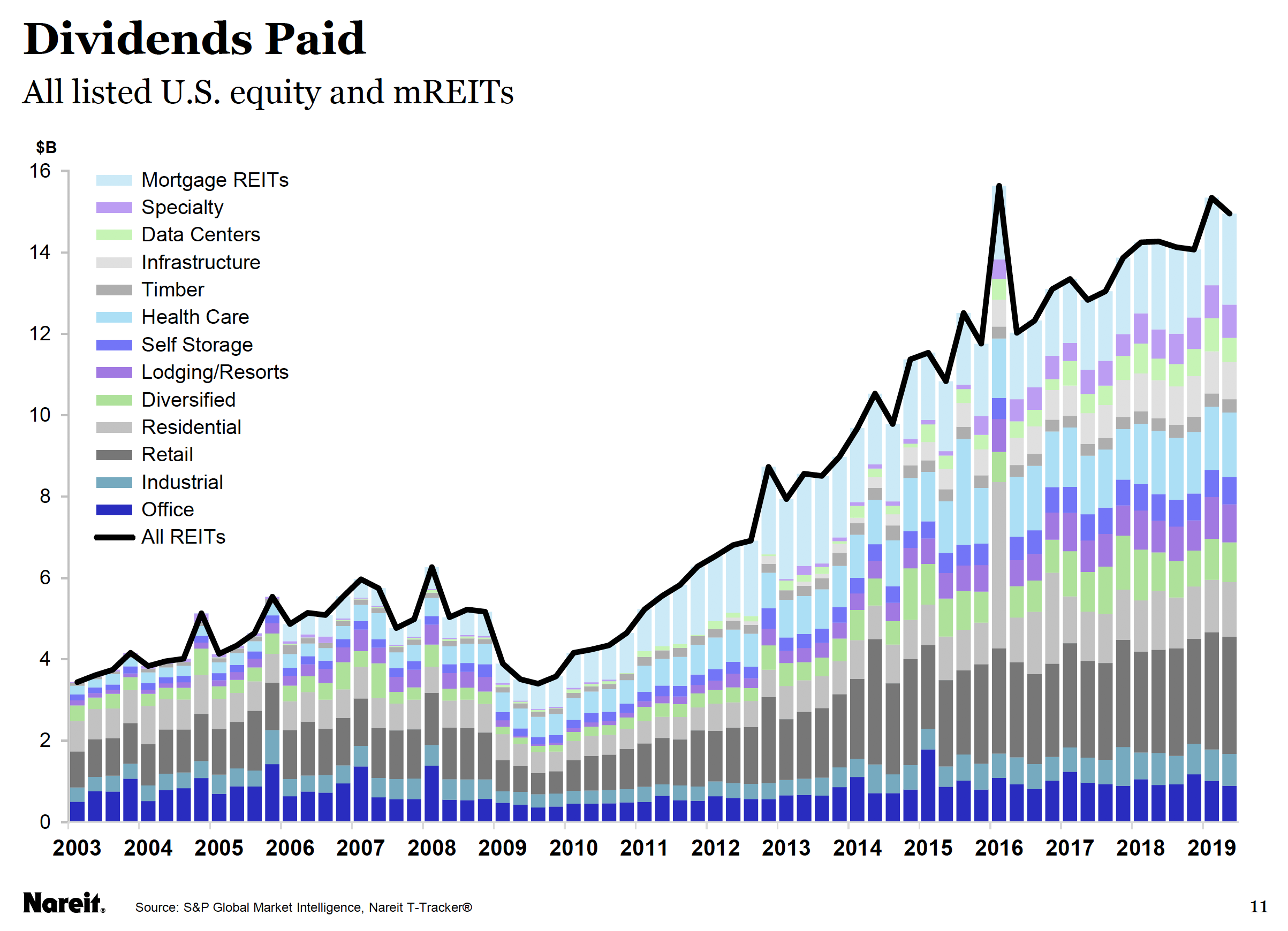

The Mystery Of Reit Dividend Cuts In The Great Recession Seeking Alpha

Guidance On Real Estate Investment Trusts

Uk Reits A Summary Of The Regime Fund Management Reits Uk

A Short Lesson On Reit Taxation

Uk Reits Property Investing Like A Boss Foxy Monkey

Uk Dividend Tax 2020 Reit Dividends Tax Us Stocks Etc Youtube

Reit Dividends And Uk Tax Assura

Us Reit Tax In Uk Investing Trading 212 Community

How Dividend Reinvestments Are Taxed

Uk Reits A Summary Of The Regime Fund Management Reits Uk